september child tax credit payment short

The IRS bases the monthly amount of the child tax credit on 2019 and 2020 tax returns. The next Advanced Child Tax payment is due to go out on October 15th.

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

WJW While some parents didnt receive the September child tax credit payment because of a glitch in the system last month others did get a payment in their hands.

. IR-2021-188 September 15 2021. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17.

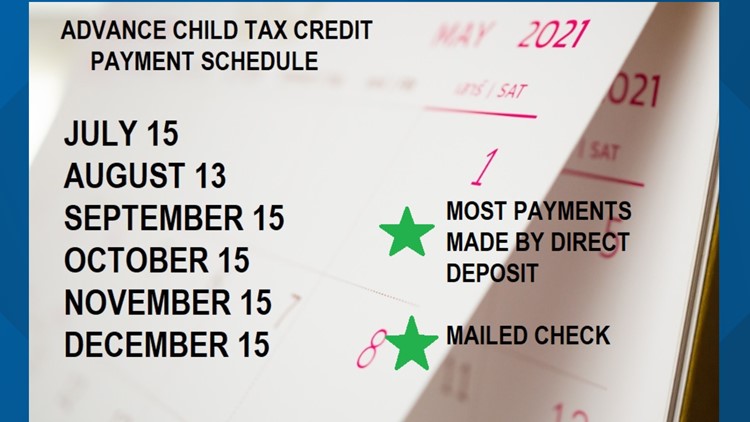

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Subsequent stimulus checks will be sent to households on October 15 November 15 and December 15. The Internal Revenue Service IRS has made 2021 Advance Child Tax Credit payments since July.

The next child tax credit payments will start arriving on September 15. Update your payment method in. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children over the age of 6 and it rose to 3600 from 2000 for children under the age.

There are reports however the September payment was short or did not. That glitch affected about 15 of the people who were slated to receive direct deposit payments for the August child tax credit money. If youre eligible find advance Child Tax Credit payments for 2021 in the Processed Payments section.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Whether or not another IRS glitch is. September 17 2021.

Millions of families across the US will be receiving their third advance child tax credit. Eligible families who do not opt-out will receive 300 monthly for each child under 6. The monthly child tax credit payments of 500 along with the pandemic unemployment benefits were helping keep his family of four afloat.

The IRS explained Friday why some September child tax credit payments may be less and why some payments went out late. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. What should you do if you havent received a payment or got the wrong amount.

Should a households income increase or if your child ages out of an eligibility bracket. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. Eligible families who do not opt-out will receive 300 monthly for each child under 6.

After eight days of delay some families said they finally began seeing money for the Sept. John Belfiore a father of. Monthly checks have ended for now.

Next up in 5. Example video title will. Well send payments to your payment method on file.

Child tax credit money arrives but some parents say IRS shorted them.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

September Child Tax Credit Payment Hasn T Shown Up For Some

U S Energy Information Administration Eia Independent Statistics And Analysis

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Everything You Need To Know About September S Child Tax Credit And Beyond Gobankingrates

Eitc For Childless Workers What S At Stake For Young Workers Clasp

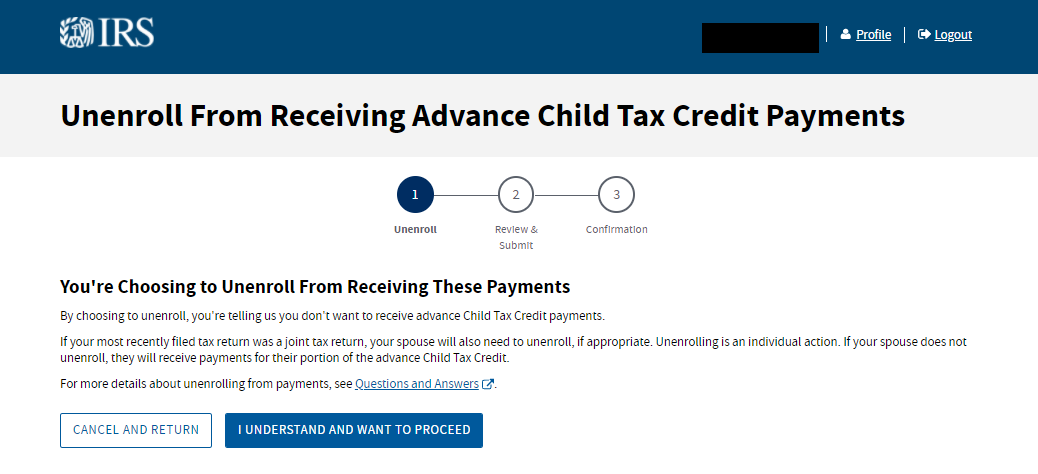

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One Youtube

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70269933/GettyImages_1328725400.0.jpg)

Unless Congress Passes The Build Back Better Act The Child Tax Credit Will End In December Vox

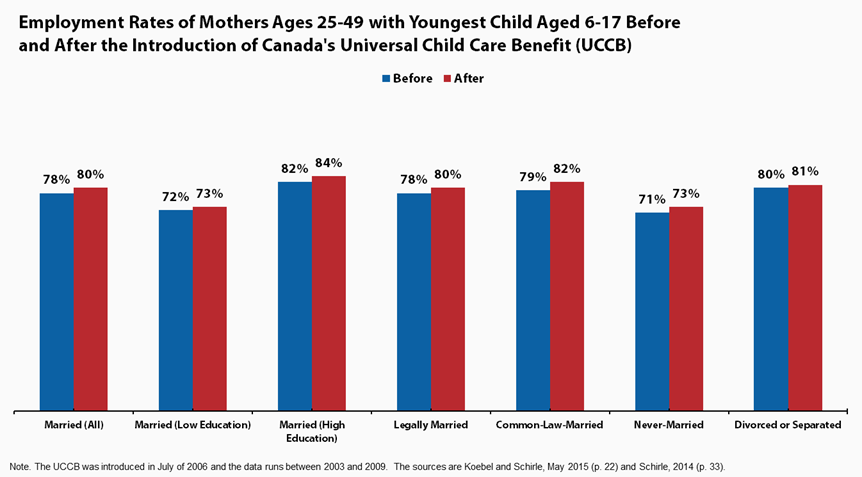

New Research Finds The Child Tax Credit Promotes Work Niskanen Center

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Child Tax Credit 2021 When Will The September Payment Come King5 Com

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VYTILFKZLBIORHBHFB56JTXA7E.jpg)

Biden S Child Tax Credit Pays Big In Republican States Popular With Voters Reuters

The Child Tax Credit Is Working Let S Make It Permanent The Washington Post

Child Tax Credits Should Promote Work Not Undermine It Child Tax Credits Should Promote Work Not Undermine It United States Joint Economic Committee